Mergers and Acquisitions!

These are buzz words in Corporate Strategic Management. Very often we see, hear and speak of two companies merging into one or one large company acquiring a small company, collaborations, etc.

What are these? Do Mergers and Acquisitions mean the same or different?

Why companies opt for these inorganic tools to achieve growth?

Let’s explore answers to these questions in this article.

Contents

What are Mergers and Acquisitions?

Mergers and acquisitions (M&A) are inorganic tools of the strategic growth of an organization. Here the alliance between the companies is the key to achieve the financial goals of the company, against focusing on core competencies in organic tools of growth.

In the case of mergers, two individual entities having an almost equal scale of operations combined into one single entity. In legal parlance, it is known as “Amalgamation” in India.

Whereas in the case of Acquisitions or takeover, one larger entity acquires the smaller ones in the market. The company which is acquiring the other company is the acquiring company and the company which is getting acquired is termed as the target company, which ceases to exist after the acquisition.

The former entity may purchase the assets of the latter company and with its assent, it acquires another company, which is known as Friendly takeover or, it may acquire or purchase the shares of the smaller company in the market at a higher price than the market and gain control over the smaller company, which is termed as “Hostile takeover”.

Types of Mergers

Horizontal Merger

If a merger is between two entities, which are in the same industry producing similar products in the same product line, then it is termed a Horizontal Merger.

Here, the merger is between two competitors, and the new larger combined entity provides the ability to face competition effectively in the market with more resources.

The merger of Vodafone and Idea can be cited as an example of this. Both telecom operators in the same industry merged to gain higher market share and survive the tough cut-throat competition of other players in the segment.

Also, acquiring a higher market share by an increased the customer base of the entities is one of the objectives behind this. It enables bulk production and reduces cost the involved in producing a product.

Therefore, strives to achieve higher profits and growth for the organization.

Vertical Merger

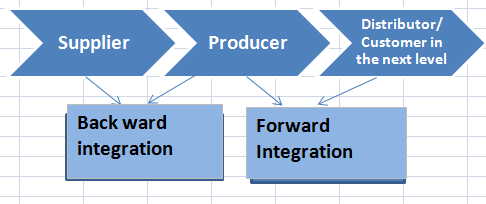

If a merger takes place between the producer the other members in the supply chain, then it’s called a vertical merger.

For example, if a producer merges with the supplier of the raw material, eliminating one of the links in the supply chain to reduce the cost, then it is backward integration.

A supplier comes before the producer in the value chain. Whereas, if the producer merges with the distributor or any other institution in the value chain, to increase his profits and, gain control and efficiency in the distribution network, it is called forward integration.

In 2016, Future group acquired Heritage foods, which would supply milk, milk products, milk powder, cooking butter, etc for resale. This integration is backward integration, as it is integration with a supplier to the concern.

A vertical merger increases the control or bargaining power of the merged entity over the value chain, ensuring that the merged entity captures higher profits, which it had to forego in the buyer-seller transactions.

Conglomerate Merger

Diversification is the mantra of success. Suppose, if one of the products fails in the market, then the other product in the portfolio builds the competence to attain a competitive advantage over the other players in the market.

If mergers are between two entities producing unrelated products or into different fields, then it is a Conglomerate merger. It’s a shortcut in entering new markets or new segments.

Benefits of Mergers and Acquisitions

When you have mergers and acquisitions that improve the quality of your product, the ability to grow, and bring better efficiency, it’s good for all.

—Roger Agnelli

1. Synergy

In simple terms synergy 2+2=5. You may wonder, but this is what I trying to explain!!!! Mathematically it is wrong!!! But in the case of mergers and acquisitions, it is explained like this. The value of one combined entity is higher than the value of two individual units valued separately.

A synergy advantage is gained in the following ways: Operational synergy and financial synergy

Operational Synergy is attained through cost-cutting and economies of large-scale operations. If two entities are merged, overlaps or duplication of efforts is eliminated and bulk purchases and production reduces the overall cost of production, which reduces cost, increases cash flows, profits, and operating efficiency of the concern. The growth of the organization can be achieved through operational synergy.

Financial Synergy- If there are tax deductions for the alliance, it reduces taxable income and generates more cash flows to the business.

Or the debt borrowing capacity of the combined entity is higher than that of individual firms, which eases fundraising program for an investment through which financial synergy can be achieved.

Also Read;

2. Talent pool

It brings the talent pool required for efficient management, which increases forecasting abilities, value judgments, and developing appropriate strategies to achieve competitive advantage.

A horizontal merger eliminates one of the competitors in the market and increases the customer base to the offerings. This maximizes the market share of the company to achieve market leadership.

It often costs less to acquire a business with a strong market position than to achieve the same through competitive battle, as developing a product, brand, patents, customer confidence requires huge cost and a long time.

Walmart acquired Flipkart (an e-commerce giant) in India to avoid hassles in building an empire from the scratch and enter the e-commerce field within a short period.

4. Complementary Resources

Many times acquiring tools and equipment requires huge capital, which requires appropriate long-term planning and forecasting. But the simplest way to acquire resources for immediate use is to acquire a concern, which has a complementary resource.

5. Tax reliefs

If a chronic loss-making company with rich assets is acquired by a profit-making company, the acquiring company can claim tax relief from the government. It helps in expansion as well as saving cash outflows to the business.

The dark side of the mergers and acquisitions

1. Premium – Most of the time in the case of mergers and acquisitions, benefits in the future are overstated due to the lack of proper hindsight. Overvaluation and benefits exceeding payments hinge the profits of the new concern.

2. Hubris – Ego levels of key management personnel, irrational thinking, misplaced confidence may to overvaluation of the acquiring concern, which may fail to generate synergies as expected and deliver the adequate growth required for the survival of the business.

3. Monopoly – “A capitalist kills another capitalist”. Large companies with a higher customer base increased market share, higher profits, and cash flows begin to dominate over other smaller concerns and may monopolize the market. It ceases the survival opportunities of the smaller concerns.

4. Liquidity crises – High liquidity disposal to acquire reduces the cash availability of the concern. It mismatches the maturity period of cash inflows to the cash outflows, leading to liquidity crises.

5. Unemployment – Sometimes the combined entity may try to dispose of redundant assets, divest a non-profitable product line, and remove underperforming resources, which may lead to unemployment.

6. Higher prices – Monopoly and dominant positions in the market eliminate competitors and therefore in the future, the ultimate consumer may have to pay a higher price for the product.

Also Read; Mergers and Acquisitions – Financing & Valuations

Overall, if mergers and acquisitions are contributing to the financial and economic welfare of the internal and external stakeholders, then it is truly an ingenious tool for business development.

Good read