Understanding the nature and growth of the business and measuring its profitability is indispensable for any investor to earn returns on his investment from shares to create wealth.

Business analysis i.e., analyzing company performance through its products & services, and fundamental analysis i.e., using balance sheet details to measure the performance of the company are the types of analyses, which give insights into the financial health of the company.

This article elucidates you through one of the prime tools to measure the liquidity position of the company, which is liquidity ratios. It extracts data from financial statements and helps investors to the future potential of the company.

Contents

What are Liquidity Ratios?

Liquidity is nothing but the scope of an asset or security to turn into cash, as and when dues arise. It measures the qualification of a company to meet its short-term liabilities obligations. Liquidity ratios explain the stability in the short-term financial position of the business.

Liquidity is very crucial for any business. A business incurs various short-term operational expenses like wages, rent, salary, electricity, etc. It also needs funds to acquire raw materials, run its production process and sell its goods. To meet all these expenses, a business requires sufficient liquidity.

Significance of Liquidity Ratios

Ability to meet short-term obligations

Liquidity ratios help us to calculate how much it is easy for a company to exchange its assets, inventories, or securities into cash and use them for meeting expenses as and when dues arise.

The greater the ratio, the better will be to pay down the debts and avoid delaying payments and vice versa.

Long-term survival of the business

Firms lacking sufficient funds may have to sell their assets to realize cash needs required to meet their obligations. In worst cases, a short-term liquidity position can impact the long-term health of the firm. Liquidity ratios explain the operational excellence of the company.

Benefits or losses to the firm

Delay in payments may attract higher interest rates, penalties, etc indicating the lower profitability of the business. Whereas on-time payments or earlier payments may encourage creditors to offer cash discounts.

Assessment of creditworthiness

This is very significant for banks, financial institutions, and lenders to provide short-term loans to the business. It depicts the creditworthiness of the firm.

Arrangement of Working Capital

It helps the firm in arranging working capital needs by knowing the levels of current assets and current liabilities in the business.

Choice of investment

It affects the investors’ choice of investment, as it is an influential factor in the Credit Rating of the firm. A low-grade company may not a lucrative opportunity for the investor.

Therefore, understanding this accounting tool is vital for the investor to know, how much of its obligations can be met by a business without resorting to external financial assistance. Possessing sufficient liquidity is crucial to pay dues on time.

Let’s dissect Liquidity ratios in detail in the next part of the article.

Types of Liquidity Ratios

There are the following types of liquidity ratios

- Current Ratio or Working Capital Ratio

- Quick Ratio is also known as Acid Test Ratio

- Cash Ratio is also known as Cash Asset Ratio

- Defensive Interval Ratio or Defensive Interval Period

Let us understand these ratios in detail.

Current Ratio or Working Capital Ratio

The current ratio measures the capability of a company to meet the obligations within the next twelve months or typically one year.

It also helps us to understand the company’s operating cycle, also known as the Working capital ratio.

It is calculated by dividing the current assets with current liabilities.

The current ratio is calculated as follows:

Current ratio = Current Assets / Current Liabilities

If the Current Ratio > 1, it implies that Current Assets are greater than Current Liabilities. It shows the operational efficiency and the ability of the firm to repay its short-term liabilities from its Current Assets.

If the Current Ratio < 1, it indicates that Current liabilities are more than Current assets in the firm, which means that the current assets of the company are not enough to pay the current liabilities of the firm.

If the Current ratio = 1, suggests that Current Assets and Current Liabilities are equal.

It analyses the short-term repayment ability of a firm. The ideal Current ratio for any company is 1 (one). This ratio is widely used by creditors in the lending process to evaluate the ability of the firm to repay the short-term debts

Quick Ratio or Acid Test Ratio

The quick ratio is also known as the Acid test ratio which is used to get an idea if a company or a business has sufficient liquid assets or cash or cash equivalents to meet its current obligations, without liquidating non-cash assets such as inventory.

It can be calculated as

Quick Ratio = (Cash + Marketable securities + Accounts receivable) / Current liabilities

Or it can also be written as,

Quick ratio = (Current assets- Inventory-Prepaid expenses)/ Current Liabilities

The ideal quick ratio should be 1 (one) or a little higher than one for a financially healthy business.

If there is any disruption in the regular working of the company, it starts experiencing difficulties, it may not be able to repay its dues on time, which piles up the current liabilities.

Ideally in such situations, this explains the ability to instantly repay its short-term obligations without selling inventories.

Cash Ratio

If the Creditors want to assess the ability of a firm to repay its current obligations with its cash and cash equivalents, then the cash ratio is the best tool to assess it.

The cash ratio is a measure of a company’s liquidity, which is evaluating whether the company has the ability to pay off short-term liabilities by using the liquid assets (cash and cash equivalents such as marketable securities, cheques, treasury bills, etc) within the span of one year time period.

It is calculated by dividing the cash and cash equivalents by current liabilities.

Cash ratio = Cash & equivalent / Current liabilities

Defensive Interval Ratio or Defensive Interval Period

Defensive Interval Ratio is the ability of a firm to meet its daily expenditures without using its non-current assets/long-term assets or current liabilities.

This is the variant of the quick ratio. It considers cash, marketable securities, and accounts receivables to measure the ability of a firm to meet its routine expenses, which is calculated as follows:

Defensive Interval Ratio = (Current assets- Inventory-Prepaid expenses)/ Average Daily operational expenses

Average Daily Operational expenditure = (Cost of Goods Sold + Annual Operating Expenses- Non-Cash Charges) / 365

Note: Depreciation and non-cash charges are deducted from daily operational expenses

This ratio is expressed in the number of days.

If the DIR of a company is 75 days, it suggests that a firm can operate 75 days with its liquid assets without using its long-term assets or short-term borrowings.

If the expenses of the firm are increasing then DIR can be used to determine and arrange the necessary funds, to avoid any disruptions in the normal functioning of the firm.

Also, investors to note that a negative ratio or low ratio may not be always a sign of danger.

Must Read; Important Financial Ratios Every Investor should know

Companies acquiring materials on credit but selling goods to their customers on cash may regularly have negative working capital and low Current ratios. Their higher stock turnover ratio and current liabilities do not imply the credit risk (risk of default in payments).

So, thorough parallel research of credit policy and credit collection of the firm is required to understand its working capital position and liquidity position of the business.

Here is an example worked out for our understanding:

Marico Balance Sheet, Marico Financial Statement & Accounts (moneycontrol.com)

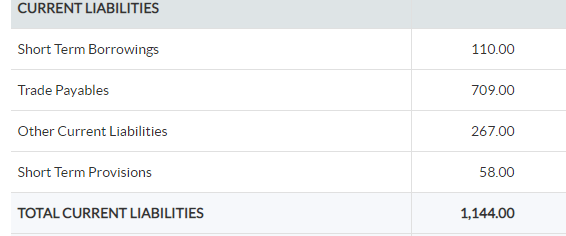

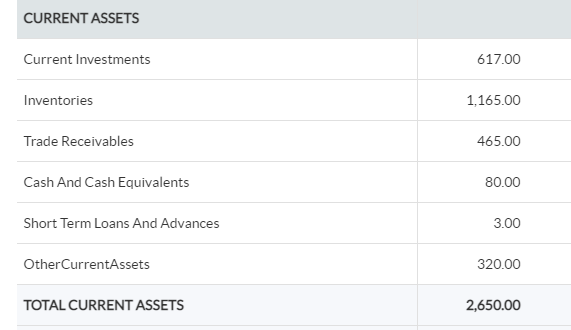

The above data of Marico Ltd is used to calculate Liquidity ratios:

The current ratio of Marico Industries is 2.32, which is higher than the ideal ratio of 2, indicating the higher current assets.

The acid test ratio of Marico Industries is 1.31, even this ratio is slightly higher than the ideal Acid test ratio prescribed, signifying the ability to meet its short-term obligations.

The cash ratio is 0.69, signifying the ability to facilitate the arousing immediate operating expenses of the firm.

Limitations of Liquidity Ratio analysis

- The current ratio value may differ from one company to another due to differences in valuation methods of inventory and investors cannot use it for relative comparative purposes.

- Sometimes, cash realized on the sale of fixed assets may overstate the current ratio. But that higher amount of cash is not part of the operating cycle of the firm

- A company selling seasonal products like sweaters, jackets, ice-creams may not have consistent liquidity ratios throughout the year. But this does not imply that those firms would earn lesser returns or has unstable liquidity position.

- Liquidity ratios use balance sheet data for computational purposes, which are historical in nature and may not be sufficient for decision making. Detailed research is essential for understanding the numbers in the ratios.

Conclusion

Therefore, liquidity ratios are crucial to the investors in assessing the ability of a firm to meet its current obligations.

It enables the company to pay its dues on time, enjoy goodwill, discounts, and better credit rating scores, which lures the bond investors as well as equity shareholders to invest in the company.

Do you think that the Liquidity Ratio should not be overlooked!

Thank you for such a great article, was very helpful to gain knowledge. Looking forward to see more articles like this.