“You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.“

This is a very famous quote from legendary investor Warren Buffett.

Then why do people lose money in the stock market??

Well, there are so many reasons why people are losing money in the stock market.

Basically, people are losing money in the stock market because of a lack of proper knowledge.

In the stock market, you need to boost your financial IQ.

Contents

10 Reasons Why do Most People Lose Money in Stock Market

Let’s Discuss some important reasons.

1. Lack of Knowledge

Most people lose money because of a lack of proper knowledge. They don’t know how the stock market works. What makes a company and business valuable? What are the right parameters to analyze a company?

If there is a good company it doesn’t mean that it will be a good investment because there may be so many reasons like overvalued, the market is going to be saturated, end of demands in case of a cyclic company, etc

Solution: Boost your financial knowledge, read some good books on investing, finance and business, have a general interest in companies, visit Insiderpedia and other financial blogs and vlogs on a regular basis to increase your financial knowledge.

2. Lack of Patience

Most people have knowledge about investing despite losing money because they lack patience.

“The stock market is designed to transfer money from the active to the patient.”

-Warren Buffett

Patience is the key to investing. Some people either buy too early or leave the company too soon.

If you have found a good company, wait for the right time to buy stocks of that company. Don’t invest in a startup or IPO because you don’t have any past performance records. Give it some time to show some good results. Avoid hot stocks because most chances are that it might be overvalued.

In the same way, sometimes we sell too early and we satisfy ourselves with the profit we made. It’s not investing. If you have invested in a company then don’t sell until you see more downward than upward, it may be sales growth, profit, prospect, etc.

What should you do?

Once again I would like to recommend the book “Education of a value investor” by Guy Spier, which helps you to know how an investor reacts especially in a stock market crash.

3. Want to get rich quickly

Some people think that the stock market is a money-making machine. It is effortless to get rich, and they expect unreasonably high returns, and they start gambling in the derivative market.

Do you know how much returns you should expect from the stock market?

Well, getting 50-60% yearly returns is very hard and only a few people are able to make money that much.

More than that is almost impossible, if somebody promises you for giving more than 60% returns, ask his/her if he/she is going to be the next billionaire?

Because anybody who can make more than 60% annual returns will easily become a billionaire someday. It’s very hard only a few have done this job.

India’s big bull Rakesh Jhunjhunwala has done this job. His compounded yearly returns are 55% since he started his investing journey.

The world greatest investor of all-time Warren Buffett compounded his wealth by 23% annual returns.

Peter Lynch one of the world’s most successful fund managers compounded Fidelity Magellan fund by 29%.

I hope you are getting some idea of how much returns you should expect from the stock market. If you will do an outstanding job you can earn 30-40%.

Experienced investors earn 20-25% in the long run and 25-35% in the bull market.

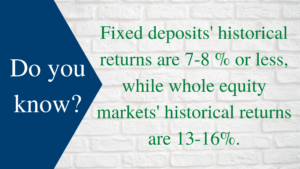

Average investors can easily get 13-16% returns but in the long run by just investing in an index fund.

4. Not knowing the risk level

As an investor, you should know the different types of risks involved in the stock market. It’s also a reason most people lose money because they don’t realize the risk in the equity market.

There can be different types of risks involved in the share market like market risk, business risk, sector or industry risk, regulatory risk, macroeconomic risk, and personal risk, etc.

5. Blindly following tips

If you are relying fully on a tip you will dip. Relying wholly on free tips doesn’t make any sense. Whenever you fell ill you consult a doctor, when it comes to marriage you consult with a pundit, when you want to make your career you consult with a career counselor but when it comes to Investing why to rely on free tips by a news channel, blog, news, chai-wala, rickshaw-wala, and stocks broker.

Remember!

There is only one job of a stockbroker. They want you to either sell or buy so that they can make a commission on every order you made either by buying or selling.

You shouldn’t follow their tips and avoid frequent trading.

Do your own research. If you don’t have much knowledge then reach out to a Sebi registered financial adviser for your financial planning.

6. Wrong belief about the stock market

Most people think that the stock market is a casino. People earn money by their luck. Having this false belief they put their money in a company by just watching their stock price chart. In this way, they start gambling and try their luck. Even if you win a couple of times but you will never win consistently. In this way, you will lose your money.

First, you should learn to never treat the stock market as a casino. Before investing do your research because, in the end, your investment value will grow only if the company will grow.

Kept in your mind that the company growth depends only on one thing which is cash-flow.

Most people don’t realize what is a share or stocks? Most people forget that share/stock is nothing but a small fraction of a company. Whenever you buy even a single share of a company you will become a part-owner of that company.

You should buy and hold companies like an owner. This is the only attitude which will make you rich because when you want to become the owner of any company you understand and study the company very closely and carefully.

In this way, you will keep yourself away from lousy businesses.

8. Lack of Confidence

If you have done your research, then show some confidence in your investment decision. Suppose you are much sure about a company based on your research that the stocks of that company could give good returns in the future.

Someday any negative news came and the stock price falls 20-30%. If you start doubting your research, then you will sell your holding even thinking about how much this bad news will affect that particular company.

Sometimes stock prices drop more than 15-20% without any reason. In this case, you need to be patient and confident about your investment decision.

In some cases, not showing confidence is affect on overall returns. Suppose you have found a really good company at a great price and you only allocate 5% of your fund.

Then the stock price doubled in a single year but the contribution of this stock will be only 5% in your returns. That’s why confidence is very necessary for making an investment decision.

9. Non-diversified portfolio

Some people don’t diversify their portfolio. They allocate 100% of their capital in a single or sometimes 2-3 companies.

Any unforeseen circumstance can happen in any company so that is yours. And you will end up with huge losses because of these circumstances.

Here the concept of diversification comes into play.

In the book, “The Intelligent Investor” Benjamin Graham recommends owning 15-20 companies to diversify your portfolio risk. But if you are going to own more than 20 companies then it is better to own an Index fund because investing in more than 20 companies i.e. 25-30 companies are the same as investing in the whole market, so it’s better to invest in an index fund.

10. Lack of good research

If you can’t do proper research then don’t invest by picking your own stocks. It’s better to consult a financial advisor or to invest through mutual funds.

If you are a beginner, then you can start investing with a small fraction of capital. By doing so you can increase capital in a self-managed portfolio as your knowledge and expertise will increase.

Conclusion:

Stock Market is not a 100 meters sprint, it is a marathon. You will need years of knowledge and research to become a successful investor.

The best investment you can do it in yourself. Read more & more books on investing, business, finance, management, etc.

You will need to read hundreds of companies’ annual reports every year, to become a great investor. If you can’t do that, then all you can do is to invest in mutual funds, which will give you good returns over time.

Have you ever lost money in the stock market?

Afaque Ali