Apple and Tesla companies in the US have made big news in the stock market. Apple has announced a 4-for-1 stock split and Tesla has declared a 5-for-1 stock split rallying companies’ share prices in the US stock market. Even in India recently Marine Electric, HDFC Nifty ETF, Bannari A SPG, SVP Global, Hazoor Multi projects Ltd, and various other companies have announced stock splits.

Marine Electric has announced a stock split from ₹ 10 to Rs 2 per share in 2020 and from February 18th, 2021, shares will be traded on an Ex-Split basis. Nothing but if you had one share earlier, it would have become 5 shares now.

Now you have a few questions in mind. What is a stock split? How does it affect investors and the company? What are the types of splits? etc… This article will give you information for all these questions, lets deep dive into the concept.

Contents

What is a Stock Split?

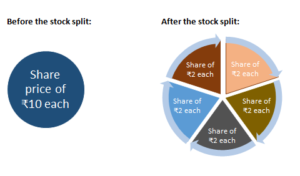

A stock split or a share split is a process by which a company increases or decreases the number of shares of the company. It changes the number of shares in the company, leaving the fundamentals’ and value of the company remaining unchanged.

This decision lies in the hands of the Board of Directors of the company.

Basically, there are two types of splits: Forward Split and Reverse Split.

Forward Split

If the company tries to increase the number of shares by dividing the existing number of shares, it termed a forward split. The above-given example of Marine Electric is an example of the forward split. One share is divided or split into five shares, increasing the number of shares of the firm proportionately, is a forward split.

- Usually, a forward split happens in the case of firms, where share prices are moving in an upward trend. By doing so, increases the share availability and encourages higher retail participation.

- Higher retail participation creates an active secondary market for the shares and provides liquidity to investors.

- Higher trading volumes surge share prices and maximize the wealth of shareholders.

- If a company finds that its shares held by few investors, which reduces the momentum of trading, then a stock split provides a solution to it.

Reverse Split

It is opposite to forward split. If the firm tries to reduce the shares by the consolidation of many shares into a single share, it is a reverse split. If the reverse split ratio is 10:1, it means that for every 10 shares held in the company, one share will be issued. It increases the face value of the share in the reverse split ratio.

- Companies sometimes face the threat of delisting from the regulator SEBI, if a minimum number of shares to be listed and traded is not maintained, as it bounded to maintain certain standards and norms, to avoid the danger of delisting, companies often reverse split their shares.

- Low stock prices elicit negative emotions and maybe ignored as a penny stock by investors. This is one of the tools to increase share value.

- If the firm finds that its shares are underpriced, it is one of the methods for correction.

Split Ratio

Often we hear 3:2 or 4-for-1, which are split ratios. It is the ratio in which shares are split, nothing but for 2 shares held 3 shares are distributed or for 1 share held 4 shares are distributed.

Important dates to be noted

Announcement Date: It is the date on which the company announces its stock split to the public. Details pertinent to split are split ratio, record date, ex-split basis, etc. are informed to the investors

Record date: This date is important to know the eligibility for a stock split. The record date is when existing shareholders need to own the stock in order to be eligible to receive new shares created by a stock split.

Effective Date or Ex-Split Date: The new price of a share on an Ex-split basis is applicable from the effective date. The date when the new shares show up in investors’ demat accounts and the shares trade on a split-adjusted basis.

To be clearer with dates, let’s understand with the help of an example. As the image depicts, in the case of HDFC Nifty ETF announcement date was 20th March 2020 and share prices are reduced from ₹761 to ₹76 and it is effective from 17th February 2021, which is an effective date or Ex-Split date.

A forward stock split is the most widely practiced form in India. Either in Bonus issue or in stock split (Forward stock split) share prices are reduced proportionately, and investors would get confused between these two concepts.

The next part of the article aims at clarifying the differences between these two terms:

Difference Between Stock Split & Bonus Issue

|

Bonus Issue |

Stock Split |

||

|

Before |

After (Assuming reserves are converted to Bonus shares) |

Before |

After |

|

5,000 Equity shares of ₹10 each – ₹50,000 |

10,000 Equity shares of ₹10 each –₹1,00,000 |

5,000 Equity shares of ₹10 each – ₹50,000 |

25,000 Equity shares of ₹2 each – ₹50,000 |

|

Reserves – ₹50,000 |

Reserves – None |

Reserves – ₹50,000 |

Reserves – ₹50,000 |

|

|

|

|

|

|

Total Paid up capital = ₹1,00,000 |

Total paid up capital = ₹ 1,00,000 |

Total Paid up capital = ₹1,00,000 |

Total Paid up capital = ₹1,00,000 |

- Concept – Bonus shares are free shares issued to shareholders and shareholders are entitled to receive free shares from the company, but in-stock split the investor is not the recipient of any free shares, instead, it increases (Forward split) or decreases (Backward Split) the number of shares held by him. It just changes the denomination of shares.

- Paid-up capital – Reserves are converted into shares in case of bonus shares, and therefore it is also termed as capitalization of reserves, and finally, this conversion results in increased paid-up capital of the firm. Paid-up capital remains unaffected in a stock split, only the denomination of par value of share changes.

- Purpose – Companies having accumulated reserves and profits, willing to reward investors but due to paucity of funds, opts for a bonus issue. Cash conservation and rewarding investors are twofold objectives, behind bonus issues. But split share action holds altogether a different rationale. If shares are traded at very high prices, obstructing small retail investors from trading, this is one of the tools used by the management to reduce share prices. Reduced share prices encourage small investors to actively trade in the market

Even though there are a few differences between Bonus Shares and Split Shares, neither of these affects the fundamentals’ or value of the company. Also, stock dilution does not happen.

Related;

Pros of Stock Split

Here benefits to investors and the company are discussed as follows,

- Affordability – As the share prices increase beyond a point, small investors may feel it pinches their pockets and it is not for them. When shares are subdivided into a smaller denomination, it is affordable to small retail investors who are aspirants to acquire for a long time. ₹10 shares becoming ₹2 per share promotes more retail participation.

- Attracts new investors – The actual value of the share does not change a bit but when the price comes down. It attracts new investors, which brings new thoughts, ideas to the business.

- Appraises demand – The existing shareholders may have a higher number of shares and thus higher retail participation increases the trading volume, increasing profitability to its investors.

- Increases Liquidity – More outstanding number of shares steers more trading thus providing liquidity to existing investors.

- Share prices – Stock splits are signal to the market that shares are available at lower prices now, later it leads to higher trading volumes in the near future and share prices will increase in the near future and therefore it takes share prices to the next notch.

- Entitlement – In a case in the future, if the company issues bonus shares then these entitled to more shares in the firm, leading to a higher capital base in the business.

- Free of cost – the investor need not spend anything to acquire split shares offered by the company.

Cons of Stock Split

Drawbacks suffered in the stock split are explained as under.

- Record keeping – Increased share base complicates the bookkeeping, escalates recording keeping costs and clerical job to the company.

- Expensive – this involves legal charges, notifying charges, documentation charges, clerical work, etc. which is an additional expense to the firm. Bankers and stock keepers are required to update their electronic records.

- Volatility – Volatility is nothing but changes or fluctuations in the share prices. Higher retail participation and trading volumes bring volatility to the share prices. Higher share prices supported by high demand may not be sufficed by the fundamentals of the company. Overpricing of shares affects the investment value in the long run.

- Track record – Stock split reduces share prices proportionately and later increased demand surges share prices. But in the technical charts’ prices are adjusted, difficult to keep a track record of events.

- Reverse stock split – Reverse stock split upsurges share prices making it dearer for smaller retail investors, discouraging higher retail participation.

Here is an example of Hazoor Multi projects Ltd, it had announced a stock split from the face value of ₹10 to ₹4 per share in 2020 and its ex-split basis is followed from 1st Jan 2021, these details are automatically adjusted in the software, price drops and breaks, event details cannot be located in the chart now.

(Hazoor Multi Projects | Splits > Media & Entertainment > Dividends declared by Hazoor Multi Projects – BSE: NSE: (moneycontrol.com)

Closing Thoughts

Share price increase beyond a level hinges on retail investors’ participation in the trading activities. Stock splits are tools to encourage higher retail participation, providing liquidity to the investments, leaving fundamentals and value of the company unchanged.